Chapter 3

Bookkeeping and Accounting

Note: With the introduction of our Hot Dog Cash Tracker Bookkeeping Software you can now do all of your bookkeeping with the click of a button. If you want to understand the accounting principles that our software was built around, please continue reading.

I can see the dread in your eyes as you read the words “book keeping and accounting”. Don’t worry, there’s nothing to it. In fact, don’t even think of it as “book keeping” or “accounting” at all. In this section you will simply learn to be a record keeper. This is written for the person with no background in book keeping or accounting. My goal is to teach you basic business record keeping for two purposes. First, so that you can have an accurate picture of your financial condition at any given moment. Second, so that you will have a clear and understandable set of records for your accountant to use at tax time. Should you keep your business records on paper or use a computer? It doesn’t matter. If you already know how to use QuickBooks, Peachtree, or other accounting software, then use it. The computer doesn’t make math errors, saves time, and gives you a more complete picture of your business. On the other hand, manual record keeping is easy and you don’t have to learn a complicated new software program. In fact, the computer just does the same thing that you do when you keep the books by hand, only faster. Since this isn’t a computer book, I’ll be covering manual record keeping so you can get up and running now. If you want to use a computer (you will eventually), then learning this section will allow you to better understand the results that the software spits out.

Rule number one – In order to keep accurate records, you must keep business and personal finances separate. The first thing you need to do is visit your local bank and open a business checking account. From that point on, pay for every business expense by writing a check (or using a business-only credit card), deposit all business income into the business checking account, and when you want to pay yourself take a “draw” by writing a business check made out to yourself. Rule number two – Keep all receipts, bank statements, and cancelled checks for three years.

There are two methods of accounting, cash and accrual. The difference lies in when transactions are recorded. In the cash method, income is recorded when you receive it (when you deposit a check), and expenses are recorded when you pay them (when you write a check). Simple. In the accrual method, income is recorded when it is generated (when you bill the customer, not when you receive payment) and expenses are recorded when incurred (if your hot dog supplier allows you 30 days to pay, the expense is still recorded on the date of purchase, not when you pay the bill). Not as simple, but it more accurately reflects the financial condition of a business that buys or sells on credit. Once you hit $1,000,000 in sales, the IRS makes you use the accrual system if you sell on credit. Until then, you have your choice. For now, we’ll use the simpler cash method.

There are two “ledgers” in which you will “post” (record) the daily transactions of your business: the income ledger and the expenditure ledger. There is a third ledger called the credit ledger, but since this is a cash business, it doesn’t apply to us. When you receive a payment from a customer, you will record it in the income ledger. The expenditure ledger tracks all of your company’s outgoing payments including personal draws and business expenses. These ledgers can be found in the appendix. Feel free to make copies to use in your own business.

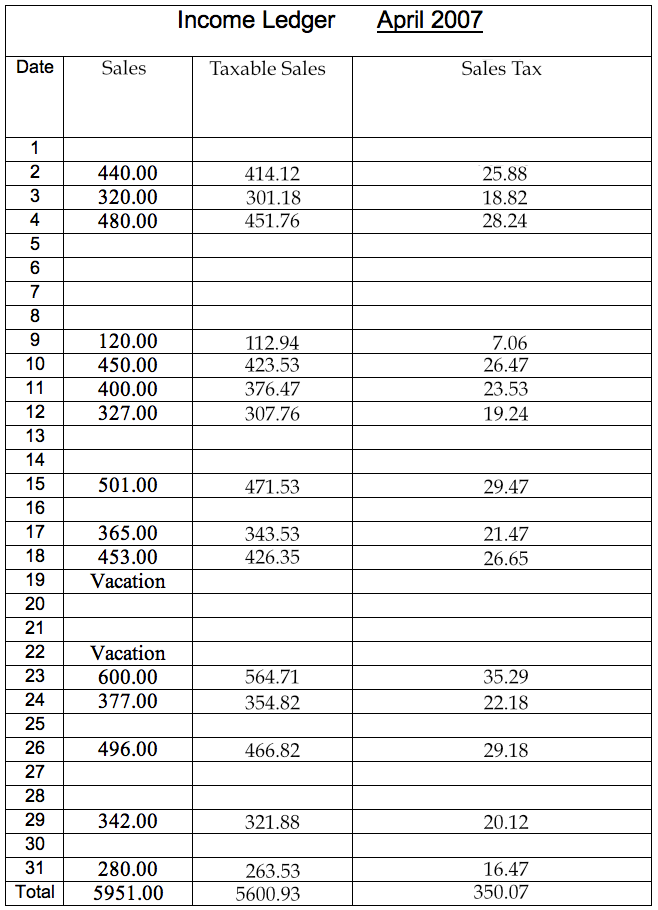

The income ledger is used to record the payments received from customers each day. In addition to showing how much income the company has earned, it is useful for analyzing trends such as busy or slow periods. All of your sales are taxable, and the income ledger will simplify the reporting process. Posting to the income ledger is easy. Enter your daily sales in the Sales column. Divide Sales by 1 + your tax rate (if your tax rate is 6.25% then divide Sales by 1.0625) to determine Taxable Sales and enter that number in the Taxable Sales column. Subtract Taxable Sales from Sales to determine the Sales Tax that you owe the state. Special thanks to HDP Member Patrick McIntyre for his valuable input.

Write a receipt for each day’s Taxable Sales, staple them together at month’s end, and file them away. Like all business documents, you need to keep them for three years. If you receive any bad checks, file them in a folder marked “Bad Debt” to be entered in the Expenditure Ledger at year-end (explained later). At the end of the year, transfer the column totals to the Income Ledger Year End Summary and total them up. That’s it – it’s easy if you do it daily. If you get behind, the odds of making a mistake increase dramatically. Then you’ll start hating what could be a fun activity (seeing the money add up!).

Right click here to download the income ledger in an Excel spreadsheet. (Thanks again to Patrick).

The expenditure ledger differs from the income ledger in that you can’t combine payments and enter them on a single line. The purpose of the expenditure ledger is to track all of your payments by category so that you can see how much you spend in each area of your business. Each payment will be entered on a separate line. Post each expense the day you pay it. If you make purchases by credit card, post the expenses on the day you pay your statement. Break down the statement total into separate purchases so you can post each to the correct category. If you are a sole proprietor, you are allowed to pay business expenses with a personal check or personal credit card. Just be sure to post the payments to the expenditure ledger. This may come in handy if your business experiences a cash crunch, but I don’t recommend it as a regular business practice. Posting expenditures is simple. Refer to the sample expenditure ledger in the Checklists and Contracts. For each payment, fill in the date and check number. If you paid with cash, write “Cash” in this column. If you paid with a credit card, write “CC XXXX”, the X’s being the last four digits of the card number. This will keep things straight in case you use more than one credit card. Fill in the name of the person or business to whom the payment was made, and the total of the payment. Then post the payment to one or more of the following detail columns.

(1) Supplies – This includes all materials that go into, or are consumed by, the process of selling your products. There is an important reason that this column is titled “Materials”, not “Inventory”. If a company keeps inventory then it can only deduct the cost of the inventory that went into goods that were actually sold during that year. Any inventory that is unsold as of December 31 cannot be deducted until the following year when it is actually sold. This means you have to calculate the partial value of the remaining inventory at year end based on the percentage that went into products actually sold that year. Does that sound like a big hassle? Yes it does. Let’s make life simple by not keeping “inventory”. We’ll operate on the assumption that you purchase supplies as you need them, and that they are completely consumed at the end of the year. This category would include hot dogs, buns, chips, soda, condiments, napkins, bags, etc. (including freight charges). These are all costs incurred in the course of selling your goods.

(2) Rent – This column is used to record the rent that you pay a landlord in exchange for the right to vend on his property. It also includes commissary rent.

(3) Utilities – If you use water or electricity at your vending site, and you pay for it as a condition of your lease (separate from the rent payment), you would record those payments in this column.

(4) Marketing – This includes printing costs for marketing materials such as flyers, menus, punch cards, etc. It also includes the postage associated with mailing your marketing pieces. An easy way to keep marketing postage separate from incidental postage is to buy only enough stamps for the exact number of marketing pieces you will be mailing. That way you will have a receipt listing the correct amount of marketing postage.

(5) Office Supplies and Postage – Pencils, paper, stamps for mailing bills and marketing pieces.

(6) Employee payroll – The payroll expenses are posted in column six as well as in a separate Payroll Ledger that breaks the expense down into its components. We will briefly cover hiring and it’s associated costs later. For now I’m assuming you have no employees.

(7) Auto Expense – If you use your own vehicle to tow your cart, or for other business related travel such as going to the wholesaler, or office supply store, the mileage is deductible as a business expense. Keep a small notebook in your vehicle and each time you make a trip on company business, write down the date, starting and ending mileage, and destination. At the end of the month, total the mileage and multiply by the Standard Mileage Allowance and post it in column 7. The 2007 rate is 48.5 cents per mile. The complicated alternative to taking the Standard Mileage Allowance is to keep itemized records of all vehicle expenses which are then prorated based on the percentage of business miles driven in order to calculate the deductible portion in addition to the prorated portion of vehicle depreciation including purchase price and the price of major repairs… just stick with the Standard Mileage Allowance.

(8) Licenses and Taxes – Post here any fees for licenses or permits. Also post any sales tax you collected from customers and paid to the state. Do not include sales tax you paid on food supplies, office supplies, etc. These sales taxes should be included in the purchase price of these products.

(9) Miscellaneous – Association dues, education expenses (including books), minor repairs, and interest on business loan payments. Anything that is deductible but does not recur often enough to warrant it’s own column.

(10) Non-deductible – Personal draws, repayment of business loans (principle only, interest is posted to the “Miscellaneous” column). If you receive a speeding ticket while on company business, it is a business expense but it’s not deductible. Post it in this column.

At the end of the month, total all columns and cross check by adding the totals from columns 1 through 10. This sum should equal the total column. Draw a double line under the totals and continue to post the next month’s expenses on the same page, below the double line. At the end of the year, post the totals from each month to the appropriate columns on the Year End Expenditure Summary. Total the columns and cross check as usual. Post the returned (bounced) checks and any other uncollectible debt under “Additional Expenses”. You’re finished!

Hi! Steve How do you do the tax on your items like here in Montgomery, AL its 10% so if I sell like a hot dog chips soda for $5.50 tax included and a sausage, chips ,soda tax included how you fig. it out? I know it is different than just adding 10% on the total isn’t it? Plus on the 50 menus I can’t put my website on them web address to long. so I have to do without but it gives me and I deal on how to have it done.

Calculating and charging tax on each order is way too difficult. Selling “tax included” is the way to go. You will simply owe the state ten percent of your total gross sales for each reporting period.

What is the formula for you use for tax included how do you do it? Do you add tax to each item?

I don’t. Calculating and adding tax on each order is way too time consuming. I just pay the state sales tax on the total of all sales once a quarter. I treat it as an operating cost.

For those of you reading this in the year 2020 and after, I explained to Steve earlier that the easy and accurate way to figure your sales tax is to divide your total sales by 1 plus the amount of your state sales tax, so if you have $300 in sales and your state sales tax is 6.5%it would be 300/1.065, which comes to $281.69; you then subtract that amount from your gross sales of $300, which gives you $18.31 which is the amount of sales tax you owe to your state government.

Got A ? If for some reason you have to recover your computer to factory condition will you lose your cash tracker? Because I might have to do it. My computer is acting bad.

Not as long as you are performing a back up each time you add data. Save that back up to a disc or thumb drive, that way if your computer crashes all you have to do is download a new copy of the software and install it on the new computer, get a new activation code from me, and restore your data to the new program.

Thank You Steve

Would a computer be an office supply expense?

No, office supplies are consumables such as printer paper, pens, printer ink, etc. A computer is considered equipment, similar to your cart.

Steve,

So with his question about the 10% which would be .55 correct? Don’t we just pay what our mark up was if we buy our product tax exempt? For example if my product is $2 and I sell it for $6 I make a $4 profit, don’t I pay the tax just on my profit? At 10% that would be .40, correct?

No, you always pay sales tax on the gross sales. You pay income tax on the profits.

How do you pay income tax when you take a draw as the owner?

Draws are taxable income to be reported on your personal tax return.